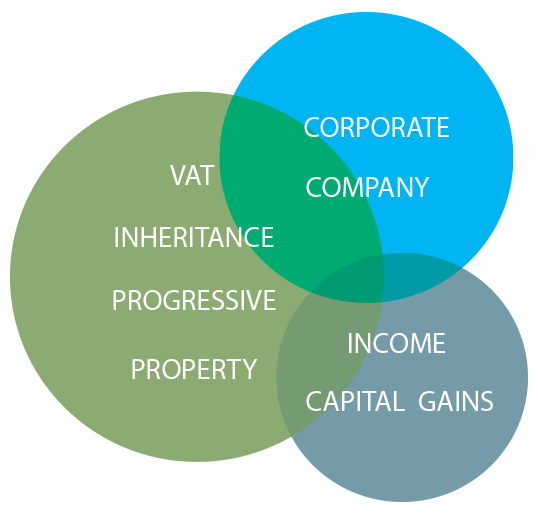

To ensure you and your business are tax efficient we take time to understand your financial position and forward plan to minimise your tax liabilities.

BUSINESS TAX

Every business has some form of taxation to pay and we can help you in with VAT, PAYE and National Insurance, Corporation Tax and Capital Gains Tax.

TAX FOR INDIVIDUALS

We offer a full tax service for individuals from completing your self-assessment tax returns to advising on Capital Gains Tax.

INCOME TAX

If you are self-employed, a company director, have annual income over £100,000, own a rental property or for a number of other reasons are required to complete a self-assessment tax return we can help.

CAPITAL GAINS TAX

You are taxed on profits made when disposing of an asset, such as a second home or a business. You will need to complete a tax return to declare this disposal and pay any tax due. We can help to identify any reliefs available which may help reduce your tax liability.

CORPORATION TAX

A company is a separate legal entity and pays corporation tax on the taxable profits of the company. We look after limited companies and calculate the corporation tax due and deal with the filing of their corporation tax return. We can also deal with any other queries which may arise to ensure their tax affairs are in order.

INHERITANCE TAX

Effective IHT planning can help to protect your wealth and minimise the tax liability due on your Estate. With our link with Robson Financial Limited, we take the time to understand your current financial situation and your anticipated future needs to develop a plan to minimise any inheritance tax due.

If you would like to discuss your tax position why not give us a call on 01404 597155.